irs child tax credit 2022

The first potential glitch of tax season involves new concerns about the accuracy of some letters that the IRS is sending out relating to the child tax credit. The change to this years tax filing is because the American Rescue Plan enhanced the existing child tax credit increasing the benefit to.

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

The Internal Revenue Service said it.

. These updated FAQs were released to the public in Fact Sheet 2022-29PDF May 20 2022. Find answers about advance payments of the 2021 Child Tax Credit. 2021 Child Tax Credit and Advance Child Tax Credit Payments Frequently Asked Questions Internal Revenue Service.

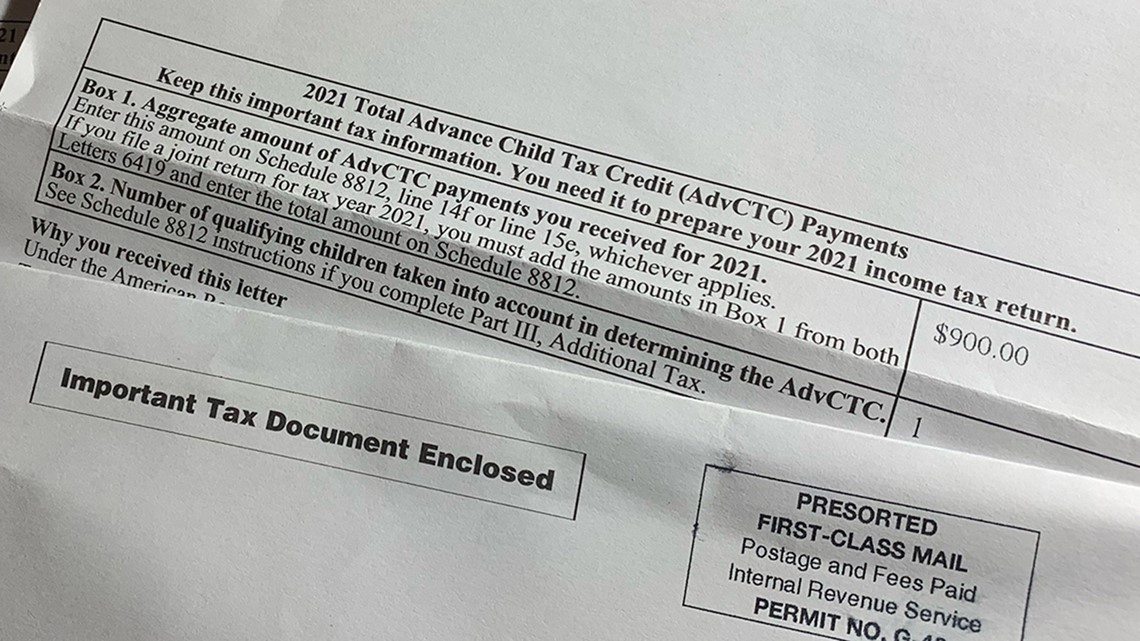

Using this information when preparing a tax return can reduce errors and delays in processing. For more read about the biggest changes for this tax season how to track your tax refund when to file taxes in 2022 and what to do if the. To get money to families sooner the IRS is sending families half of their 2021 Child Tax Credit as monthly payments of 300 per child under age 6 and 250 per child between the ages of.

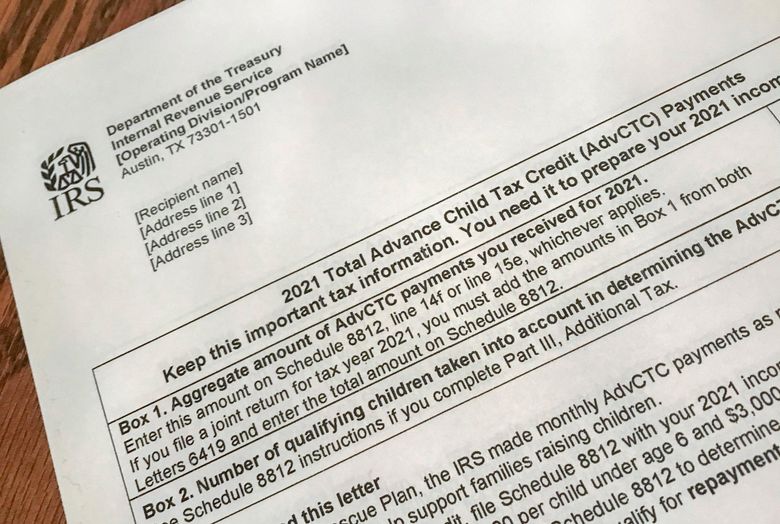

In 2021 Congress passed the American Rescue Plan which expanded the child tax credit for most American families increasing the amount to 3600 per child under 6 and 3000 for kids 6 to 17. IR-2021-255 December 22 2021 The Internal Revenue Service announced today that it will issue information letters to Advance Child Tax Credit recipients starting in December and to recipients of the third round of the Economic Impact Payments at the end of January.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 8962 Premium Tax Credit Definition

Irs Faces Backlogs From Last Year As New Tax Season Begins Npr

Tax Season 2022 Tips For A Speedy Refund And How To Avoid Gumming Up The Works The Seattle Times

Taxpayers Must Provide Ids Face Scans To Sign Into Their Irs Accounts The Washington Post

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Tax Tip Caution Married Filing Joint Taxpayers Need To Combine Advance Child Tax Credit Payment Totals From Irs Letters When Filing Tas

What Is Irs Letter 6419 And Why Does It Matter Before You File Taxes Where S My Refund Tax News Information

/cloudfront-us-east-1.images.arcpublishing.com/gray/AZXLCRNHQ5GI7LVGR72GFTAW7M.jpg)

Irs Urges Parents To Watch For New Form As Tax Season Begins

Irs Offers Multiple Ways To Pay Cpa Practice Advisor

Expansion Of Child Tax Credit Helped Feed Children In W Va Wvpb

Irs Gives Taxpayers One Day To Rightsize Child Tax Credit November Payments November 1

What Families Need To Know About The Ctc In 2022 Clasp

How To Call The Irs With Tax Return And Child Tax Credit Questions Cnet

On Tax Day Treasury Makes A Plea For More Irs Funding The New York Times

Irs Warns Of Child Tax Credit Scams Abc News

The Irs Has Sent Nearly 30 Million Refunds Here S The Average Payment

Irs Recovery Rebate Tax Credit 2022 How To Claim It Next Year Marca

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet